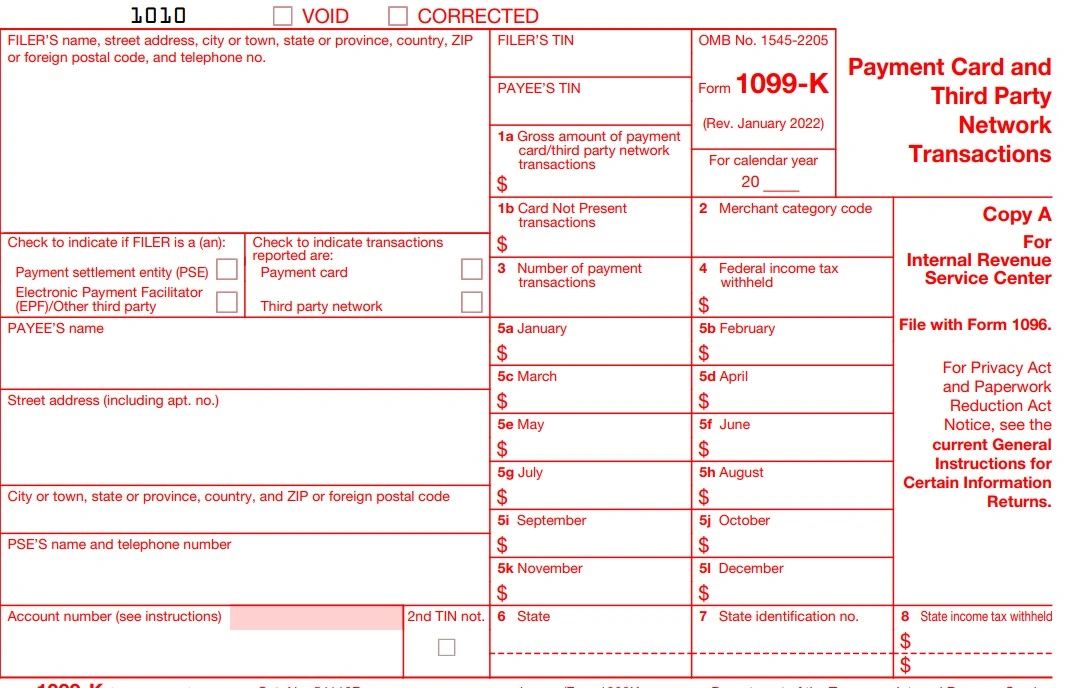

1099 Example 2024 – If you earn more than $5,000 on payment apps like Venmo in 2024, you should automatically get a 1099-K tax form. Here’s what you need to know. . The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. .

1099 Example 2024

Source : blog.checkmark.com

Form 1099 K: One of the upcoming tax season’s biggest headaches?

Source : taxcpanj.com

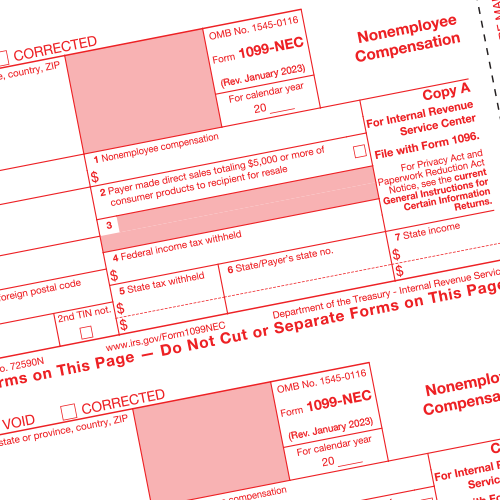

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

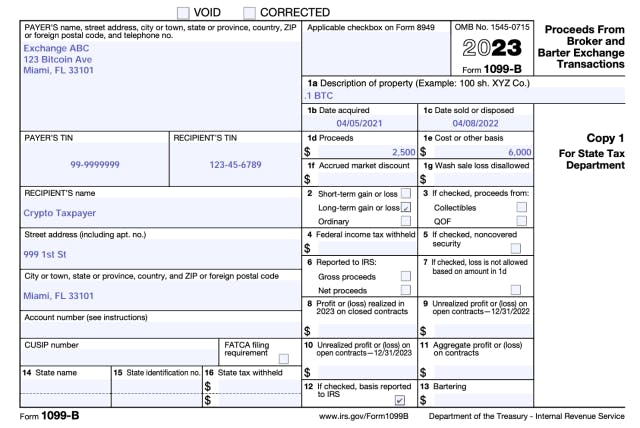

Comply Exchange Ltd on LinkedIn: 2024 Form 1099 B

Source : www.linkedin.com

Tax Resources

Source : www.eagleviewfiling.com

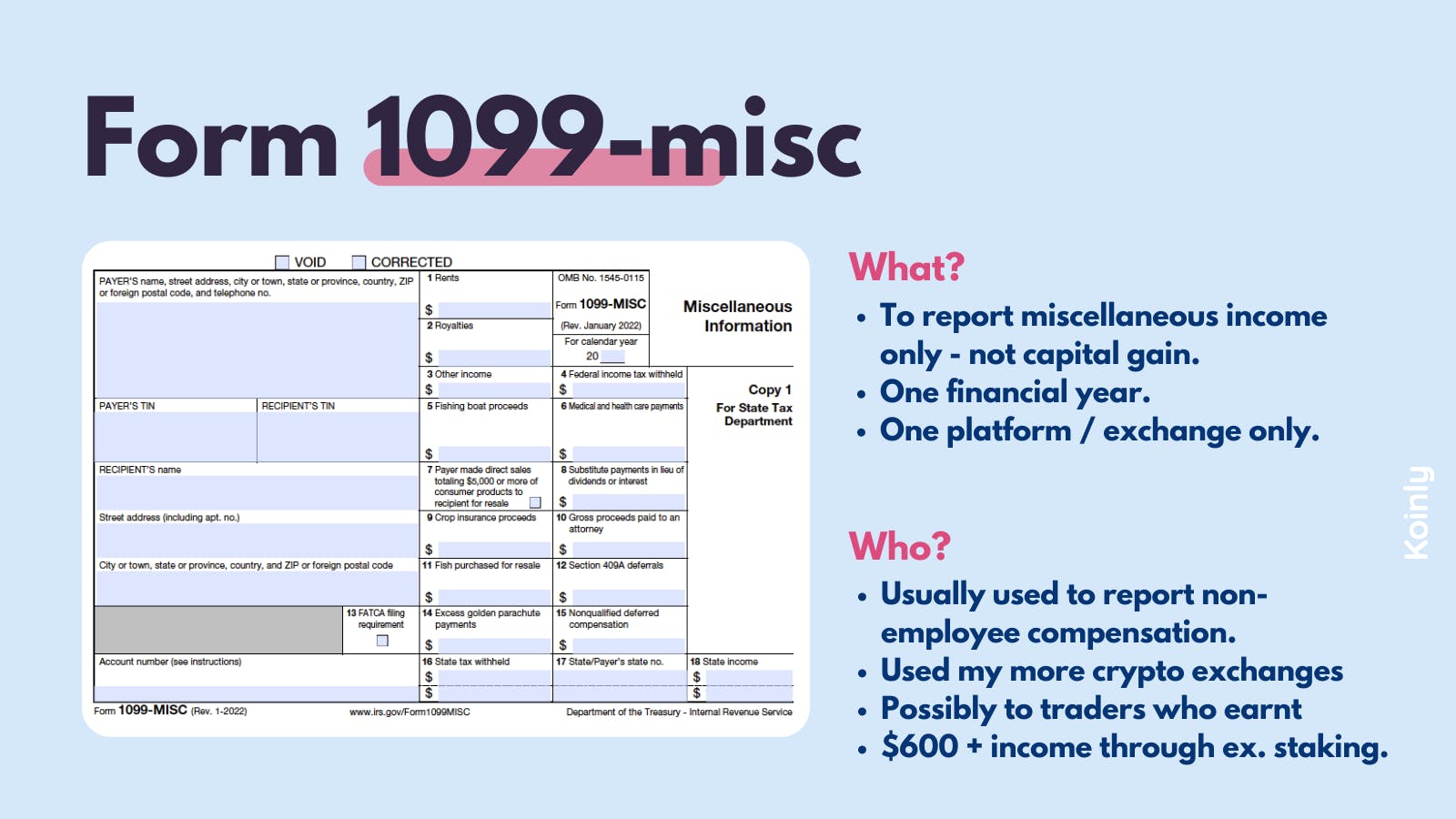

IRS Crypto 1099 Form: 1099 K vs. 1099 B vs. 1099 MISC | Koinly

Source : koinly.io

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

Crypto Forms 1099 in 2023 Accointing by Glassnode | Accointing

Source : www.accointing.com

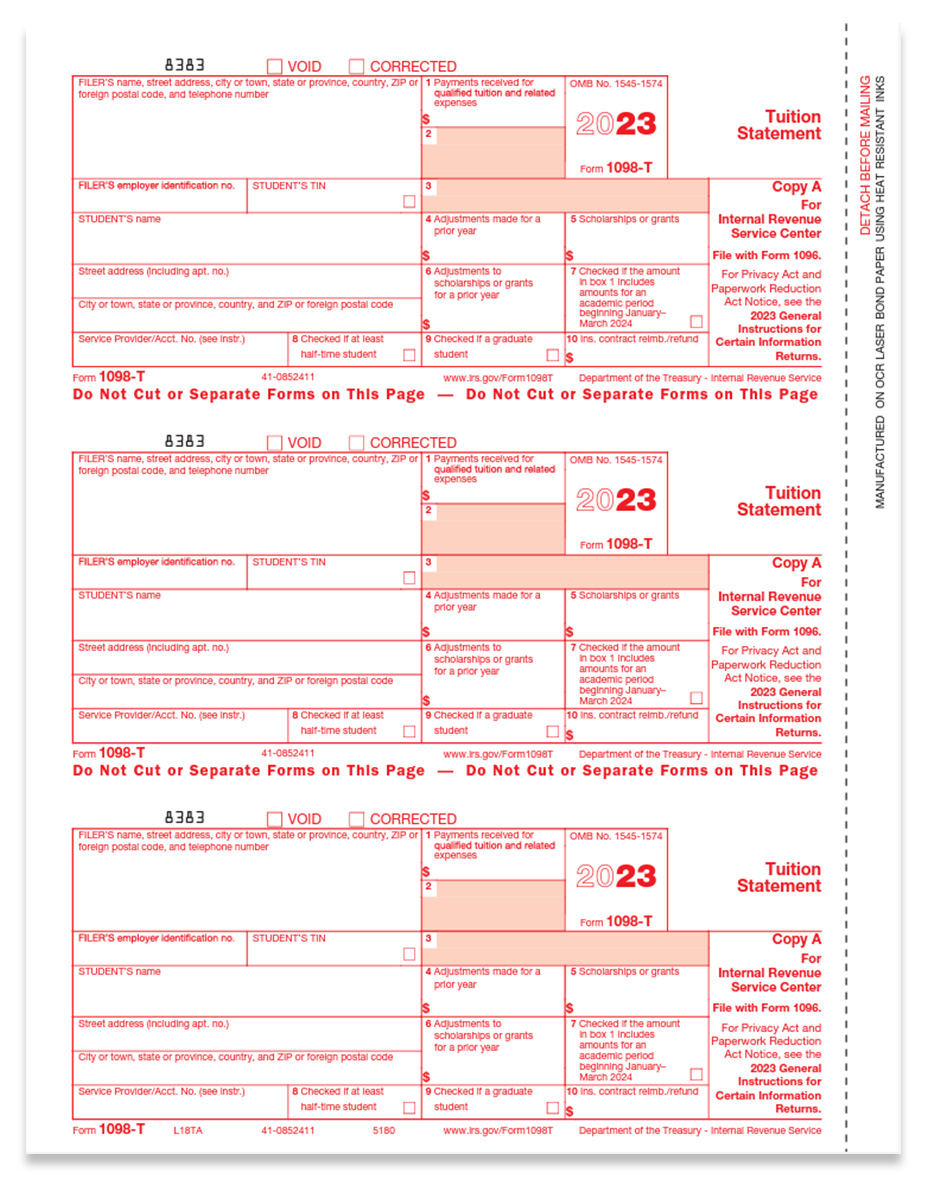

1098T Tax Forms for 2022, Tuition Statement DiscountTaxForms

Source : www.discounttaxforms.com

How to File 1099 MISC for Independent Contractors

Source : blog.checkmark.com

1099 Example 2024 How to File 1099 NEC in 2024 — CheckMark Blog: In November 2023 the IRS changed the threshold amounts for tax years 2023 and 2024 example, those with side hustles, crafters, small businesses, and gig workers—could still receive a 1099 . The Internal Revenue Service said Tuesday it would postpone the $600 threshold for reporting transactions on Form 1099-K for the second year in a row, and begin to phase in a threshold of $5,000 .